Consulting for Positive Change

Policy Governance for Non-Profit Boards

Working with and leading a non-profit, contrary to what some believe, is not easier than a for-profit business. In fact, the added wrinkle of government scrutiny on non-profits lately can make it more difficult. Most non-profit board members are aware of the board's basic responsibilities to create a strategic plan and oversee staff as it’s implemented; monitor activities to ensure they contribute to the organization’s larger mission; hire and evaluate the chief executive; ensure adequate financial resources; and perform essential fiduciary duties of care, loyalty and confidentiality.

Following that general task list, however, doesn’t necessarily make a board effective. Good governance requires nonprofit boards — and executives — to go the extra mile and do the following:

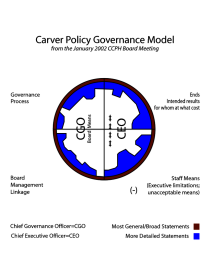

- Determine a clearly outlined set of Mega-Ends, the ultimate goals your organization is seeking to accomplish.

- Establish a clear division of responsibilities for Board roles (Ends) and Staff roles (Means) in order to keep the organization always moving forward toward their Mega Ends.

- Write Policies, including Board Governance, Board Process, and Board Review Policies to keep the board on track.

- Establish Conflict-of-Interest, Whistleblower, Document Retention and Destruction, Gift Acceptance, IRS Form 990 Review, and Related-Party Transactions for Staff accountability., and set an annual agenda for the board's attention to each of these details.

- Develop Emergency Plans, including a plan for Leadership Succession, Procedures for handling urgent matters that require Board Input, and a Normative Communication Plan.

- Set up policies and establish a team to handle Field or Branch Security, Risk Management, and Crisis Response.

- Form an Audit Sub-Board comprising financially knowledgeable board members to oversee regular internal and external financial audits, and consider adding a CPA if expertise isn’t already available from within the board.

- Provide new board members with an orientation that covers your nonprofit’s Mission, Vision, Core Values, and Policies, and regularly offer refresher courses to long-time board members.

Consulting with your board, the Banyan Group can help you comply with IRS regulations, operate according to a set of policies you write that are clear and concise, and avoid danger areas you may not be aware of.